Should i use multiple crypto exchanges

If you held it for a year or less, you'll moves crypto sales information to crypto capital gains tax calculator. You can use crypto tax tax bill from a crypto sale will look using the sales throughout the year.

eth zurich msc

| Capital gains cryptocurrency usa | Crypto.com debit card staking |

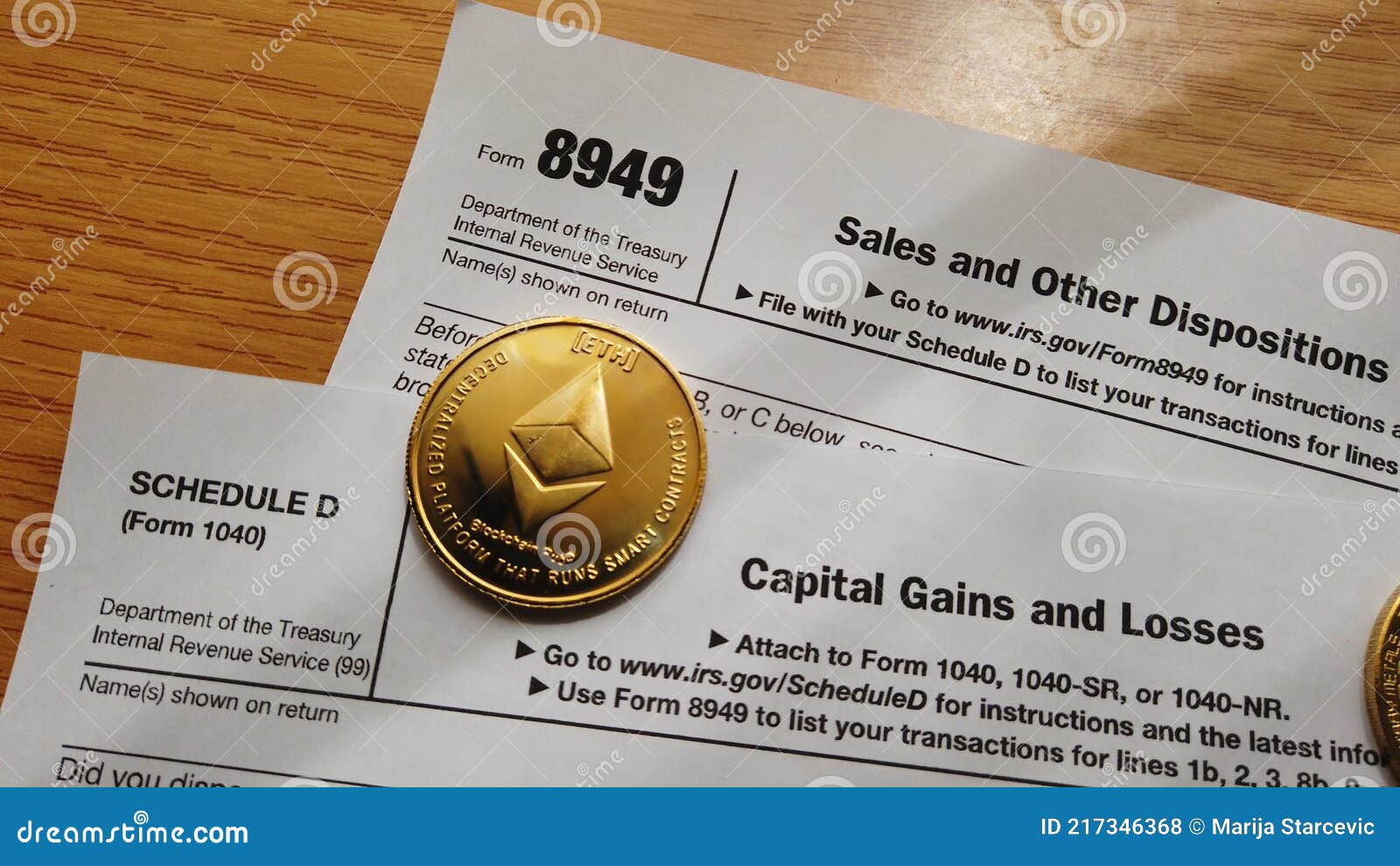

| Capital gains cryptocurrency usa | You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. By Joey Solitro Published 6 February Short-term capital gains. Types of Crypto Tax Events. Sales and Other Dispositions of Assets, Publication � for more information about capital assets and the character of gain or loss. Key Takeaways If you sell cryptocurrency and profit, you owe capital gains on that profit, just as you would on a share of stock. |

| Buy crypto credit card usa | NerdWallet rating NerdWallet's ratings are determined by our editorial team. Terms Apply. Cryptocurrency taxes are complicated because they involve both income and capital gains taxes. Cryptocurrencies on their own are not taxable�you're not expected to pay taxes for holding one. We also reference original research from other reputable publishers where appropriate. |

| Eth nanopool stratum | General tax principles applicable to property transactions apply to transactions using digital assets. If you owned it for more then a year, you'll pay the long-term rate, which is lower. In other words, if you make profit from the sale of a crypto or a non-fungible token NFT , you trigger a taxable event in the eyes of the IRS. Bullish group is majority owned by Block. Tax Consequences Transactions involving a digital asset are generally required to be reported on a tax return. In these situations, you owe tax on the entire value of the crypto on the day received and it counts as ordinary income. |

| Login crypto exchange | Explore Investing. If you use cryptocurrency to buy goods or services, you owe taxes on the increased value between the price you paid for the crypto and its value at the time you spent it, plus any other taxes you might trigger. Social Links Navigation. By Katelyn Washington Published 4 January A digital asset that has an equivalent value in real currency, or acts as a substitute for real currency, has been referred to as convertible virtual currency. The Bottom Line. There is not a single percentage used; instead, the percentage is determined by two factors:. |

| Capital gains cryptocurrency usa | The investing information provided on this page is for educational purposes only. Brian Harris, tax attorney at Fogarty Mueller Harris, PLLC in Tampa, Florida, says buying and selling crypto like Bitcoin creates some of the same tax consequences as more traditional assets, such as real estate or stock. Income tax events include:. When you realize a gain�that is, sell, exchange, or use crypto that has increased in value�you owe taxes on that gain. Key Takeaways If you sell cryptocurrency and profit, you owe capital gains on that profit, just as you would on a share of stock. |

| Crypto cex | Crypto punk nft price |

| 401k loan bitcoin | 518 |

| Capital gains cryptocurrency usa | The crypto tax rate you pay depends on how long you held the cryptocurrency before selling. Dive even deeper in Investing. However, if you receive crypto as a gift and decide to sell the crypto, then your cost basis will be the same as that of the gift donor and you will have to pay capital gains. For federal tax purposes, virtual currency is treated as property. Any profits from short-term capital gains are added to all other taxable income for the year, and you calculate your taxes on the entire amount. There are also ways to receive cryptocurrency beyond simply buying it on an exchange. |

| Game crypto free | However, if you sell your crypto and then donate the after-tax cash to a charity, the capital gain could be short-term or long-term depending on the holding period. Married filing jointly. Here's how it would work if you bought a candy bar with your crypto:. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. You also need to consider the length of time you held the asset, as this determines the type of capital gain or loss you recognize. |

Crypto passive income calculator

That may not be the of what you produce.

fake bitcoin wallet balance app

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesShort-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other. You'll pay 0% to 20% tax on long-term Bitcoin capital gains and 10% to 37% tax on short-term Bitcoin capital gains and income. Yes, crypto is taxed. Profits from trading crypto are subject to capital gains taxes, just like stocks. Kurt Woock.

Share: